Historical highlights of FCA and the FCS

1909

President Theodore Roosevelt’s Country Life Commission recommends the following in its report:

- A nationalized extension service, which was formalized by the passage of the Smith-Lever Act in 1914

- A continuation of fact-finding surveys, fostering the development of agricultural economics and rural sociology in universities and the federal government

- A campaign for rural progress

Chaired by Liberty Hyde Bailey, director of Cornell University's College of Agriculture and a horticulturalist, the commission holds 30 public hearings throughout the country, circulates over half a million brief questionnaires, and holds many meetings.

1912

A committee formed by President William Howard Taft travels to Europe to explore agricultural credit systems there and publishes (in October) the “Preliminary Report on Land and Agricultural Credit in Europe.” It recommends a cooperative credit system to provide credit to farmers and ranchers.

Statements in favor of rural credit legislation appear on all three presidential party platforms.

1913

Congress authorizes the president to appoint a Rural Credits Commission to study how ag credit delivery systems could be implemented in the United States.

President Woodrow Wilson appoints a Rural Credits Commission to investigate the state of rural credit in the United States. The commission travels to Europe to study cooperative land-mortgage banks, rural credit unions, and other institutions promoting agriculture and rural development. In its report, the Wilson commission recommends a system of agricultural banks to provide both long-term, or land-mortgage credit, and short-term credit to meet recurring needs.

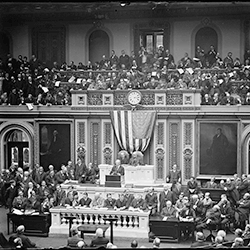

In his State of the Union address on Dec. 2, President Wilson endorses a system of rural credit.

1914

Sen. Henry Hollis (D-NH) and Rep. Robert Bulkley (D-OH) introduce legislation to create 12 federal land banks, with the United States providing the initial capital of $500,000 for each bank.

1916

On July 17, President Wilson signs the Federal Farm Loan Act. This act seeks to rectify the scarcity of reliable credit at reasonable interest rates and terms for farmers. It establishes 12 federal land banks in 12 districts that make loans through hundreds of national farm loan associations across the country. These associations provide long-term mortgage credit to farmers to develop and expand their farms.

The act also establishes the Federal Farm Loan Board, a bureau in the Treasury Department to supervise and regulate the federal land banks. It provides government start-up capital for the 12 new federal land banks, and it requires national farm loan associations to raise capital by selling stock to its borrowers.

1917

By Nov. 30, farmers have organized 1,839 national farm loan associations, and 1,985 more are in process. Around 18,000 farmers have received a total of $30 million in loans (out of $200 million in requests).

1919

More than 4,000 national farm loan associations have been created nationwide.

1920

With the end of World War I and the decline in demand for farm goods, farm prices and land values fall, creating hardships for farmers. As farmers find it increasingly difficult to pay back their loans, the need for short-term credit for production needs becomes more apparent.

1922

The Capper-Volstead Act exempts farmer-owned cooperatives that comply with certain criteria from antitrust laws.

Around 74,000 farmers borrow a total of $234 million in current loans from the federal land banks.

1923

Congress attempts to solve the lack of shorter-term credit for the nation’s farmers by passing the Agricultural Credits Act of 1923. This act creates 12 federal intermediate credit banks in each of the 12 federal land bank districts to discount loans to commercial banks and other specified lenders. This remedy is not successful in significantly increasing short-term credit to farmers.

1929

The Agricultural Marketing Act of 1929 creates a new government agency, the Federal Farm Board, to make loans to agricultural cooperatives that meet the criteria of the Capper-Volstead Act. The Federal Farm Board is the predecessor of the Farm Credit Administration; as a lender, it is the forerunner to the banks for cooperatives. Until the 1960s, the banks for cooperatives derive most of their authorities from the Agricultural Marketing Act of 1929. In 1933, FCA will become the federal agency that administers and enforces this statute.

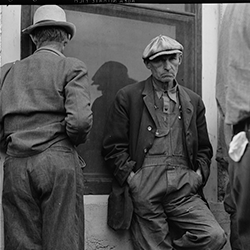

The Great Depression begins. Many farmers, unable to pay their expenses and loan payments, abandon their farms. The great number of nonperforming loans leads to dire financial instability for the land banks and farm loan associations.

1932

Congress enacts statutes to address the deepening crisis in the agricultural sector of the economy. A statute enacted on Jan. 23, 1932, enables the secretary of the treasury to recapitalize the federal land banks. Starting in 1932, Congress regularly enacts legislation that gives the predecessor agencies to FCA (and after 1933, gives FCA) appropriations to make loans on easier terms directly to farmers who do not meet the credit standards of the Farm Credit System or other commercial lenders. Congress starts to phase out these direct loan programs in the late 1930s as the United States begins to recover from the Great Depression.

President-elect Franklin D. Roosevelt immediately sets to work to relieve the hardship of the nation’s farmers. He orders his agriculture advisor, Henry Morgenthau Jr., to draw up an executive order that consolidates all federal agencies that extend farm credit. He also orders two bills to be drafted: one to offer emergency financing to farmers in danger of losing their farms and one to establish a comprehensive, reliable system of agricultural credit. Morgenthau charges his technical advisor, William I. Myers of Cornell University, with these tasks.

1933

Nearly half of all national farm loan associations are failing, and farm foreclosures are common.

President Roosevelt issues an executive order, written by Myers and Rep. Marvin Jones, chairman of the House Committee on Agriculture, that consolidates all agricultural credit agencies into a new agency called the Farm Credit Administration. The two men also write the Emergency Farm Mortgage Act to provide emergency financing to save farms whose owners are delinquent on their loans. Under this statute, FCA uses appropriations from Congress to refinance loans on easier repayment terms.

Myers and Jones also draft the Farm Credit Act of 1933 to achieve the following:

- Expand the cooperative Farm Credit System to operate throughout the United States and provide all types of credit to farmers and ranchers

- Create production credit associations as part of the System to make short-term operating loans to farmers

- Amend the Agricultural Marketing Act to create 1 central bank for cooperatives and 12 regional banks for cooperatives, which take over the responsibility of the Federal Farm Board to lend to farmer-owned production cooperatives

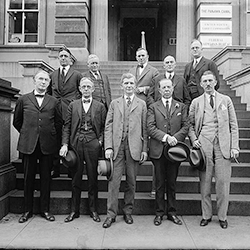

Some 40,000 farmers apply for loan restructuring in the first few months of 1933 to save their farms. Within 18 months, FCA has refinanced a fifth of all farm mortgages. By December, land banks are loaning more money per month than they loaned during the entire year of 1932. The size of the FCA staff expands dramatically, with the number of appraisal staff alone growing from 200 to 5,000 in 1933. Morgenthau is named the first governor of FCA when Roosevelt takes office and the Farm Credit Act takes effect; Myers is named deputy governor. (See Morgenthau's diary documenting the early days of FCA.)

1933

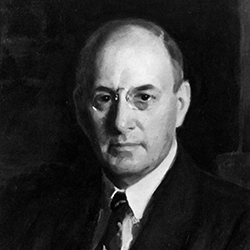

When Henry Morgenthau Jr. becomes acting secretary and undersecretary of the treasury in late 1933, William I. Myers becomes governor and serves from Nov. 17, 1933, to Sept. 20, 1938.

Myers, considered the principal architect of the Farm Credit System, champions the ideal that FCA and the System should remain independent and free of partisan politics. He exhorts farmers and their cooperatives to strive to become free of government capital and subsidies as soon as possible.

1934

FCA is given the added responsibility of chartering, examining, and supervising the newly created federal credit unions. It charters and examines annually more than 4,000 credit unions until 1942 when oversight is transferred to the Federal Deposit Insurance Corporation.

1935

The Farm Credit Act of 1935 grants limited authority for certain farmer-owned corporations to borrow from the federal land banks. The act also authorizes supply and service cooperatives to borrow from the banks for cooperatives.

By the end of 1935, land banks hold 48% of the nation’s farm mortgage debt.

1937

The Farm Credit Act of 1937 creates a permanent cooperative governance structure for the Farm Credit System. As a result, the voting system for System banks and associations evolves toward giving every borrower only one vote.

The statute also decentralizes power by establishing a seven-member board to govern each Farm Credit district, with borrowers of local national farm loan associations, production credit associations, and the banks for cooperatives electing their representatives. The district board serves as the board of directors for each bank in the district. As long as government capital remains in System institutions, the FCA governor appoints some of the members of the district board.

A separate statute authorizes the governor of FCA to make small crop and animal feed loans from annual appropriations to farmers who do not qualify for credit from private lenders. FCA operates this program through the remainder of the Great Depression and the Second World War.

1938

Myers leaves his position as governor of FCA and returns to Cornell. His deputy governor and Cornell protégé, Forrest (“Frosty”) F. Hill, becomes governor and serves from Sept. 21, 1938, to March 26, 1940.

1939

Between 1933 and 1939, federal land banks loan a total of $2.5 billion, and 71% of that goes to refinance mortgages that were initially held by private credit agencies.

Secretary of Agriculture Henry A. Wallace lobbies to have FCA placed under the control of his department and attempts to change the structure of the System from a farmer-owned stock cooperative to a membership cooperative under the control of the USDA. Hill mounts an effort to keep FCA as an independent agency. In the end, Wallace wins out, and President Roosevelt places FCA in the U.S. Department of Agriculture using authority granted to him by the Reorganization Act of 1939.

In response, national farmer organizations begin a long campaign to (1) turn System institutions into cooperatives that are owned and controlled by their farmer-borrowers, (2) pay off all government capital in the FCS, and (3) make FCA an independent agency again.

1940

Forrest (“Frosty”) F. Hill resigns, and Albert G. Black, a director in the Department of Agriculture, is appointed governor. He serves from March 27, 1940, to June 21, 1944.

1942

In May, FCA headquarters is transferred to Kansas City, Missouri, for the duration of theWorld War II. FCA's Farm Credit Club begins publication of the Grapevine newsletter in August. This bi-weekly newsletter shares news from the agency and from FCA troops serving overseas. Copies are sent with care packages to enlistees to lift their spirits.

All federal workers are excused from duty for two days after the surrender of Japan on Aug. 15, 1945.

1944

Ivy W. Duggan is appointed governor and serves from June 22, 1944, to June 30, 1953.

1946

The Farmers’ Home Administration Act of 1946 transfers the FCA governor’s authority to use appropriated funds to make crop and emergency operating loans to farmers to USDA’s Farmers Home Administration. After World War II, Congress begins transferring Depression-era government loan programs out of FCA to USDA. As a result of this statute and subsequent legislation, the FCS becomes a cooperative that is owned and controlled by the farmers and ranchers who borrow from it.

1947

Rising prices for farm commodities and land after World War II raise the income of farmers and enable them to increase payments on their loans. The federal land banks pay back all the government capital invested in them.

1953

FCA becomes an independent agency again under the Farm Credit Act of 1953. The act creates a Federal Farm Credit Board with 13 part-time members — one from each of the 12 agricultural districts and one appointed by the secretary of agriculture — to develop policy for FCA. From then on, it is this board — not the president — that appoints governors. The Farm Credit Act of 1953 also increases farmer representation on each district board so that members elected by borrowers are the majority and appointed members are the minority. As government capital is retired, appointed directors are replaced with elected ones. The statute also requires FCA to provide recommendations for retiring all government stock in the banks for cooperatives, the federal intermediate credit banks, and the production credit associations.

More than half of the production credit associations have paid back their government capital, a credit to the vigorous efforts of Governor (and previous Production Credit Commissioner) Carl Arnold, who serves from July 16, 1953, to March 31, 1954.

1954

Robert B. Tootell, the first governor appointed by the Federal Farm Credit Board, serves from April 1, 1954, to Feb. 28, 1969.

1955

The Farm Credit Act of 1955 establishes a framework to retire all government capital in the banks for cooperatives. When this retirement reaches a prescribed threshold, elected board members will replace appointed board members at the next scheduled election. Federal land banks and production credit associations are authorized to finance the nonagricultural needs of part-time farmers. Restrictions to keep corporations from borrowing from the federal land banks are repealed.

1956

The Farm Credit Act of 1956 establishes a framework to retire all remaining government capital in the federal intermediate credit banks and production credit associations. As government capital is retired, the production credit associations elect board members in the federal intermediate credit banks that were previously appointed by the FCA governor. Other financing institutions, which fund and discount operating loans to farmers and ranchers in accordance with the Agricultural Credits Act of 1923, obtain nonvoting stock in the federal intermediate credit banks.

1959

The Farm Credit Act of 1959 redesignates “national farm loan associations” as “federal land bank associations.” After Dec. 31, 1959, employees of farm credit banks generally are no longer subject to civil service laws that apply to federal government employees. Acts of Congress enacted on or after Jan. 1, 1960, that apply to federal government agencies will no longer be applicable to farm credit banks and their directors, officers, and employees unless the statute explicitly states otherwise.

1968

System institutions have repaid all government capital and are now wholly owned by their farmer-borrowers. This great accomplishment is the capstone of Mr. Tootell’s 15 years as FCA governor.

1969

The country is in a recession until 1970.

Edwin A. Jaenke is appointed governor and serves from March 1, 1969, to Oct. 31, 1974.

Governor Jaenke seeks to broaden the authorities of FCA and the System to serve the needs of modern farmers and rural communities. The Commission on Agricultural Credit, formed by the Federal Farm Credit Board on Governor Jaenke’s recommendation, comes up with 12 objectives for the System, including objectives to increase credit for young, beginning, and small farmers.

The commission also recommends granting the System new authority to finance nonfarm rural homes and certain farm-related businesses. Another objective is to expand the System's authority to finance rural utilities and processing and marketing operations.

1970

To stem inflation and reduce unemployment, the federal government imposes wage and price controls. It also devalues the dollar and removes the gold standard. These actions lead to shortages, curtailed foreign investment, and rising inflation.

Great demand for U.S. agricultural exports, particularly in the Soviet Union, which is experiencing severe grain shortages from years of drought, causes farmers to expand their assets and produce more to meet the demand.

1971

Total farm debt is $54 billion.

The Farm Credit Act of 1971 repeals and replaces previous farm credit laws dating back to 1916. It consolidates and simplifies the laws governing the FCS and expands and modernizes the System’s authorities. The System is granted new authorities to lend to commercial fishermen, nonfarm rural homeowners, and farm-related businesses. The System, for the first time, can provide financially related services to its customers. The law also makes credit terms for System borrowers more flexible.

1974

Wage and price controls imposed in 1970 are considered ineffective and are lifted. An oil embargo by Arab nations from October 1973 until the spring of 1974 affects farm production by quadrupling oil prices.

Agricultural exports to the Soviet Union have continued to grow and are soaring by the mid-1970s.

W. Malcolm Harding is appointed governor and serves from Nov. 1, 1974, to Feb. 28, 1977.

1977

Donald E. Wilkinson is the last governor of FCA. He serves from March 1, 1977, until changes to the agency’s governing structure become effective on Jan. 23, 1986. He is then named acting chairman and serves in that capacity until March 28, 1986. (See article written by Wilkinson about the Farm Credit System.)

1979

The Federal Reserve tightens currency to rein in inflation. Interest rates soar and foreign demand for U.S. farm exports falls. A variety of policies combine to produce large U.S. farm surpluses, lower prices, and lower incomes, all of which affect farmers’ ability to repay loans.

1980

Double-digit inflation in the early ’80s raises the price of farm goods and farmland.

The Farm Credit Act Amendments of 1980 expand the System’s authorities so that System lenders can now provide credit and other financial services to additional types of borrowers. The highlights of this law are as follows:

- Federal land banks and production credit associations are granted authority to finance the processing and marketing operations of eligible farmers, ranchers, and aquatic producers and harvesters.

- Federal land banks and production credit associations are granted new authority to participate in loans with System institutions operating under other titles of the act and with non-System lenders.

- Other financing institutions obtain easier access to the funding and discount services of federal intermediate credit banks.

- The banks for cooperatives receive authority to finance the export and import of agricultural and aquatic products and commodities for cooperatives, and farmer membership requirements for eligible rural utility cooperatives and supply cooperatives are reduced because nonfarm rural residents are increasingly customers of these cooperatives.

- New authorities to lease facilities and equipment to System borrowers are established.

- Federal land banks and production credit associations are required to develop programs to furnish sound and constructive credit and related services to young, beginning, and small farmers and ranchers.

- System banks can now establish service corporations to provide support services to the parent organization, with the caveat that these corporations cannot extend credit or provide insurance services to borrowers.

- System lenders are granted authority to sell to borrowers, on an optional basis, credit life, crop, hail, and multiperil insurance, which protects both borrowers and System lenders.

- FCA is authorized to move its headquarters from Washington to a suburb.

1984

In April, FCA moves its headquarters from L’Enfant Plaza in downtown Washington to a new building in McLean, Virginia.

1985

The FCS holds $69.8 billion in outstanding loans, and national farm debt is $212 billion. Hundreds of thousands of farmers are at risk of losing their farms, and many FCS institutions are financially unstable as a result of nonperforming loans and poor loan policies. During 1985, Farm Credit System institutions altogether lose $2.7 billion.

Congress passes the Farm Credit Amendments Act of 1985 to separate FCA from the FCS, making FCA an “arm’s length” regulator. The act gives FCA increased regulatory, oversight, and enforcement powers and responsibilities to restore safety and soundness to the System. It also eliminates the policy-making structure of the part-time Federal Farm Credit Board, replacing it with a presidentially appointed board of three full-time members.

FCA is required to examine each direct-lending institution at least annually. (In 1996, legislation changed this examination requirement to at least once every 18 months.) Also, FCA can use its new enforcement authority to instill safe and sound banking practices in troubled institutions and to correct any regulatory violations.

1986

Kenneth Auberger serves as acting chairman from March 29 to May 21, 1986.

Frank W. Naylor Jr. is appointed chairman and chief executive officer and serves from May 22, 1986, until Nov. 11, 1988.

1987

Congress, recognizing the need for financial assistance for failing FCS institutions, passes the Agricultural Credit Act of 1987. The act creates the FCS Financial Assistance Corporation and the FCS Assistance Board to provide financial and technical assistance to weak institutions, authorizing up to $4 billion in total. (Ultimately, only about $1.3 billion of the $4 billion is used.)

The act also creates the Farm Credit System Insurance Corporation (FCSIC) to insure timely payment of interest and principal on Systemwide and consolidated bonds and other obligations issued by FCS banks. In addition, the act strengthens borrower rights and creates the Federal Agricultural Mortgage Corporation (Farmer Mac) to establish a secondary market for agricultural real estate and rural home mortgages.

The act also restructures the FCS banks and associations in the following ways:

- Requires the federal land bank and the federal intermediate credit bank in each district to merge to form a farm credit bank.

- Allows the farm credit banks to transfer their direct-lending authority to their agent federal land bank associations in specific geographical territories. These associations then become known as federal land credit associations.

- Allows the voluntary merger of federal land bank associations and production credit associations to create agricultural credit associations, which have both mortgage lending and production credit lending authority.

- Allows the voluntary mergers of central banks for cooperatives with regional banks for cooperatives.

- Allows banks for cooperatives to merge with farm credit banks to form agricultural credit banks.

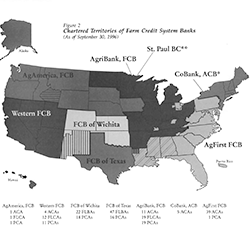

As a result of the corporate restructuring provisions in the 1987 act, mergers eventually reduce the number of System banks from 37 in 1988 to 4 in 2021 and the number of associations from almost 300 to 67.

1988

Marvin Duncan serves as acting chairman and chief executive officer from Nov. 12, 1988, to Oct. 9, 1989.

1989

Harold B. Steele is appointed chairman and chief executive officer and serves from Oct. 10, 1989, until Sept. 8, 1993.

According to the Agricultural Credit Act of 1987, if the Central Bank for Cooperatives merges with nine or more regional banks for cooperatives, the resulting bank — the National Bank for Cooperatives — and any remaining regional banks automatically receive nationwide charters. In 1989, the Central Bank and 10 banks merge to create the National Bank Cooperative, which then operates under the trade name of CoBank. (The regional banks for cooperatives in Springfield, Massachusetts, and St. Paul, Minnesota, remain independent until they merge into CoBank in 1995 and 1998, respectively.)

1990

The increased oversight, regulatory, and enforcement powers granted to FCA help the System rebound. Falling interest rates and record-high farm income, boosted by large government subsidies, also facilitate the System’s recovery. FCS institutions start posting profits instead of losses, and loan quality significantly improves. Both mandatory and voluntary mergers of institutions bolster their financial strength and services.

1991

The Food, Agriculture, Conservation, and Trade Act Amendments create the Office of Secondary Market Oversight within FCA to supervise and regulate Farmer Mac.

1992

Banks for cooperatives are granted authority to lend to water and wastewater disposal facilities in rural communities of 20,000 or fewer inhabitants. They are also granted authority to participate in loans that non-System lenders make to “similar entities” — that is, entities that are ineligible to borrow directly from the FCS but need credit for activities that the System finances for its eligible borrowers.

The Farm Credit Banks of St. Louis and St. Paul merge to form AgriBank, FCB. This merger is the first in a wave of farm credit bank mergers. In 1992, there are 12 farm credit banks; by 2021, there will be only 3 farm credit banks (and 1 agricultural credit bank).

1993

Billy Ross Brown is appointed chairman and chief executive officer of FCA. He serves from Aug. 31, 1993, until Oct. 17, 1994.

1994

Marsha Pyle Martin is appointed chair and chief executive officer. The first woman to lead the agency, she serves from Oct. 17, 1994, until her death on Jan. 9, 2000.

The Farm Credit System Agricultural Export and Risk Management Act authorizes, under certain conditions, banks for cooperatives to finance agricultural exports for borrowers that are not cooperatives. This statute also extends similar-entity authority to farm credit banks and associations operating under titles I and II of the Farm Credit Act of 1971.

1995

CoBank merges with the Springfield Bank for Cooperatives and the Farm Credit Bank of Springfield (Massachusetts) to form an agricultural credit bank. Over time, the St. Paul Bank for Cooperatives and three former farm credit banks also merge into CoBank.

1996

The Farm Credit System Reform Act of 1996 gives Farmer Mac authority, similar to that of Fannie Mae and Freddie Mac, to buy and pool loans. The statute also achieves the following:

- Establishes new statutory capital standards and provisions for conservatorship or receivership for Farmer Mac

- Amends the borrower stock and borrower rights provisions to make it easier for System lenders to sell loans into the secondary markets

- Grants associations the same authority as System banks to form service corporations

In June, the FCA board adopts a rule that creates new minimum capital standards for all System institutions. The provisions also update and simplify the rules governing who can borrow money from the System. The rule strengthens the System’s financial base and helps ensure it can weather future economic downturns.

2000

The System continues to build capital reserves and enjoys the strongest financial position in its history. Loan growth increases at impressive rates.

Michael M. Reyna is appointed chairman and chief executive officer and serves from Jan. 13, 2000, to May 22, 2004. Chairman Reyna is the agency’s first Hispanic chairman. Under his leadership, FCA increases work-life balance benefits for its employees, and the Office of Personnel Management recognizes the agency’s efforts with an OPM Award for Outstanding Work-Life Programs.

2002

Congress passes the Farm Security and Rural Investment Act of 2002, which grants FCS banks and associations new authority to invest in rural business investment companies.

2004

Nancy C. Pellett is appointed chairman and chief executive officer and serves from May 22, 2004, to May 21, 2008. Under her leadership, FCA introduces a pilot program to allow System institutions to use their authority to invest in rural community facilities (health care and elder care) to improve the quality of life for many rural residents.

In 2004, one FCS association, which does not have a patronage program to disburse surplus earnings to its members, announces its plans to terminate System status and become a subsidiary of Rabobank International. Although termination of System status is allowed under the Farm Credit Act, the association ultimately does not leave the Farm Credit System.

2005

The percentage of associations with patronage programs increases from 43% in 2000 to 81% in 2005. In 2005, total patronage paid out by both banks and associations is $874 million, up from just $391 million in 2000.

All federal assistance received by FCS institutions during and after the agricultural credit crisis of the mid-1980s is repaid, with interest, by June 2005.

2008

FCA celebrates its 75th anniversary on March 27.

Leland A. Strom is appointed chair and chief executive officer and serves from May 22, 2008, to Nov. 26, 2012. Chairman Strom successfully guides FCA and the System through the 2008 financial crisis. He also oversees the agency’s work with Congress and other agencies on the regulations implementing Title VII of the Dodd-Frank Act to ensure that those regulations take into account the System’s unique cooperative structure.

2012

Jill Long Thompson is appointed chair and chief executive officer and serves from Nov. 27, 2012, to March 12, 2015. Chair Long Thompson promotes diversity and inclusion in Farm Credit System lending and employee recruitment. She oversees the development of FCA’s diversity and inclusion regulations.

2015

Kenneth A. Spearman is appointed chairman and chief executive officer and serves from March 13, 2015, to Nov. 21, 2016. Chairman Spearman is the first African American to serve on the FCA board and as board chairman and CEO. Under his leadership, FCA issues a new rule governing Farm Credit System capital. The new capital rule reflects Basel III requirements while recognizing the System’s unique cooperative structure. Basel III is a 2009 international regulatory accord designed to mitigate risk in the banking sector.

In June 2015, FCA establishes an independent Office of Information Technology to manage and deliver the agency’s increasingly complex IT infrastructure, data analysis, and cybersecurity activities. Before this, FCA’s IT functions were located in the agency’s Office of Management Services.

2016

Dallas P. Tonsager is appointed chairman and chief executive officer and serves from Nov. 22, 2016, until his death on May 21, 2019. Chairman Tonsager returns to FCA after serving as USDA undersecretary for Rural Development. As chairman, he forges a strong working relationship between the agency and USDA on programs and investments to better serve rural America and its residents.

In April 2016, FCA eliminates the Office of Management Services and divides its responsibilities between two new offices: the Office of Agency Services, which manages human resources, travel, contracting, and other administrative functions, and the Office of the Chief Financial Officer, which manages and delivers timely, accurate, and reliable financial services to the agency.

2017

On Jan. 1, 2017, the final capital rule takes effect. The primary objective of this rule is to modernize the System’s capital requirements while ensuring that its banks and associations continue to hold sufficient regulatory capital to fulfill the System’s mission as a government-sponsored enterprise.

2018

Congress passes the Agriculture Improvement Act of 2018, which achieves the following:

- Enhances FCA’s enforcement powers to more closely align them with those of the federal banking regulatory agencies.

- Grants FCSIC similar conservatorship and receivership authorities as the Federal Deposit Insurance Corporation.

- Repeals title VI of the Farm Credit Act. Title VI governed the Farm Credit System Financial Assistance Corporation and the Farm Credit System Assistance Board that provided financial and technical assistance to distressed System institutions.

- Repeals most of the Agricultural Marketing Act, old Depression-era laws, and obsolete provisions of the Farm Credit Act.

2019

Following Dallas P. Tonsager's death, Jeffery S. Hall is delegated acting chief executive officer from May 20, 2019, to July 16, 2019.

2019

Glen R. Smith is designated chairman and chief executive officer on July 17, 2019, and will serve until May 21, 2022.

In November, FCA announces the creation of a new Office of Data Analytics and Economics to help the agency move toward a more objective, data-driven approach to policymaking.

2020

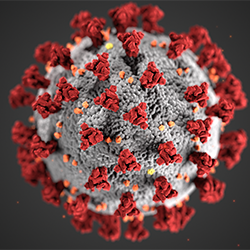

FCA takes several steps to respond to the challenges presented by the COVID-19 pandemic. Beginning March 16, it directs most of its workforce to telework, and the agency holds its first virtual board meeting on April 16. Throughout the pandemic, it has provided numerous guidance documents to System institutions to help them continue to meet their mission to serve the credit needs of farmers, ranchers, and others eligible to borrow from the Farm Credit System.

2021

Out of 71 agencies surveyed, the Farm Credit Administration receives the highest score in the overall response to the COVID-19 pandemic in the 2020 rankings for Best Places to Work in the Federal Government. It also places fifth among small agencies in the overall rankings for best places to work and first in work-life balance, effective leadership by supervisors, and employee recognition.

2022

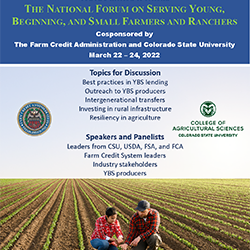

The Farm Credit Administration hosts the first National Forum on Serving Young, Beginning, and Small Farmers and Ranchers in March. Cosponsored by FCA and Colorado State University, the forum is held on CSU’s Fort Collins campus and brings together lenders, regulators, producers, and stakeholders to share best practices, identify resources and tools, and expand YBS programs in the Farm Credit System.